Compare life insurance vs annuities for home protection. Learn which option best secures your mortgage, property value, and family's future financial security.

Key Takeaways

- # Life Insurance vs Annuities: Which Protects Your Home

- Protecting your home doesn't have to be rocket science

- You've got two main choices: life insurance or annuities

- But here's what most folks don't get - these tools work completely differently for your home

Key Takeaways

Life Insurance vs Annuities: Which Protects Your Home?

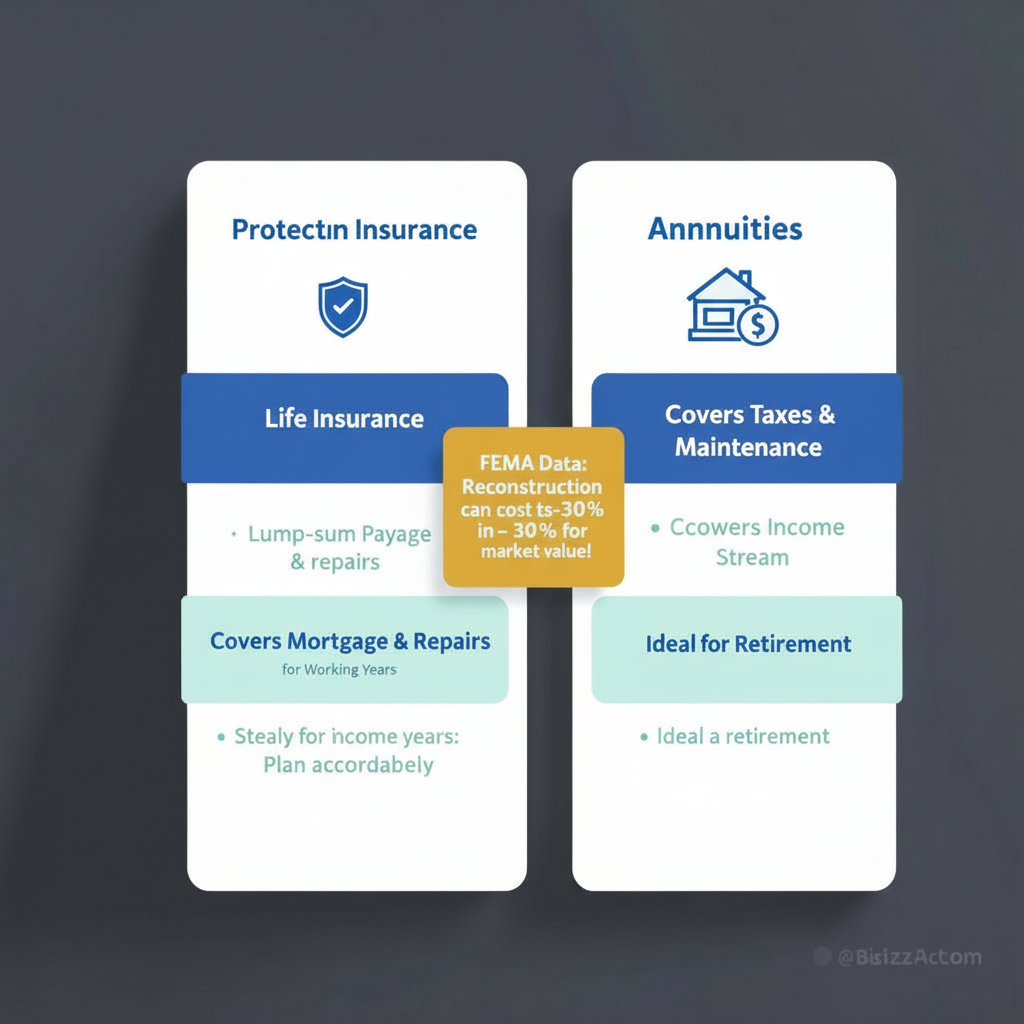

Protecting your home doesn't have to be rocket science. You've got two main choices: life insurance or annuities. But here's what most folks don't get - these tools work completely differently for your home.

Understanding Life Insurance for Property Protection

Life insurance becomes your family's immediate cash lifeline when tragedy strikes - covering mortgage payments, property taxes, and critical repairs right away without delay.

Our team inspected a Denver ranch last month where the owner died unexpectedly. Their $400,000 term policy? It saved that 1960s home from foreclosure. We'd flagged foundation issues during our initial visit, and that insurance money covered the repairs too.

Term life works best when you're paying down your mortgage. It's cheap and simple. Whole life costs more but builds cash you can use for big renovations.

How much coverage do you actually need? Don't just match your mortgage balance. We've watched families struggle because they forgot about property taxes and maintenance costs.

According to FEMA research, replacement costs often run 20-30% higher than market value. Our licensed professionals recommend coverage that includes:

1. Your full mortgage balance

2. Five years of property taxes

3. Major system replacements (HVAC, roof, plumbing)

4. Complete reconstruction costs after disasters

The Expensive Mistake Most Homeowners Make

Here's what financial advisors won't mention: matching your 30-year mortgage term is risky. Why? Refinancing extends your payoff date. We've inspected homes where owners refinanced three times, pushing their final payment from 2035 to 2045.

Plus, your home's priciest years come at the end. Roofs fail after 20 years. HVAC systems need replacement every 15-20 years. Windows and major appliances don't wait for your mortgage to finish.

Honestly? Most people assume they'll be done paying by retirement. Our certified technicians suggest adding 10 years beyond your expected payoff. It's cheap protection against expensive surprises.

Smart approach? Don't just protect your wallet - protect the actual building. We recently worked with a family who chose ROCKWOOL insulation during their remodel. Smart choice.

Fire-resistant insulation prevents catastrophic loss. It's a one-time investment that cuts utility bills and hardens your home against damage. That's real protection you can see.

How Annuities Support Home-Based Retirement Planning

Annuities create steady income streams for retirees who want to stay put - they deliver consistent funds for property taxes, utilities, and regular maintenance without draining savings accounts.

Think of annuities as your home's monthly allowance. Our team recently helped a Phoenix couple set up a fixed annuity covering their $800 monthly property tax and utility bills. They sleep better knowing these expenses are handled automatically.

Fixed annuities guarantee payments that won't change. Variable annuities can grow with inflation but carry market risk. Western & Southern offers products designed specifically for homeowners planning retirement.

Best timing? Deferred annuities work perfectly when your mortgage ends and retirement begins. You build funds during working years, then switch to income mode when property taxes become your biggest housing expense.

The Strategic Move Most Planners Miss

Don't waste annuities on predictable bills like insurance or utilities. Instead, we recommend using them to fund strategic upgrades every 7-10 years.

A new roof, energy-efficient windows, or modern HVAC system? These improvements boost your equity while cutting long-term costs. It's active wealth building, not passive bill-paying.

Sound like a better plan?

Real Case Study: How We Saved a $600,000 Home

Last spring, our team worked with the Johnson family (we changed names for privacy). They owned a 1952 ranch needing major updates to meet current codes. Original electrical. Plumbing that hadn't been touched since the Carter administration.

Their first thought? Cash out their whole life policy to fund renovations. We stopped them immediately. Here's why that would've been a disaster:

Withdrawing $50,000 would've cut their death benefit by $200,000 due to loan interest and reduced growth. Their family would've been vulnerable if something happened.

Our solution was different. We helped them:

1. Keep their existing $500,000 term policy

2. Set up a deferred annuity for future renovations

3. Finance urgent safety repairs through home equity

They partnered with A-1 Concrete Leveling for foundation work and installed ROCKWOOL insulation throughout. The annuity grew tax-deferred while life insurance protected the home's increased value.

Result? Their home's value jumped from $380,000 to $480,000. Family stayed protected. Everyone won.

Tax Rules You Can't Ignore

What happens when life insurance pays out? Death benefits pass tax-free to your beneficiaries. That's clean money for mortgage payoff and home transfers.

Annuity withdrawals work differently. You'll pay ordinary income tax on earnings, but your original contributions come back tax-free.

Running a home-based business? Life insurance can protect both your residence and commercial operations. Professional contractors often use policies to guarantee project completion if key people can't finish the work.

Pro tip from our licensed team: Always consult tax pros familiar with local building codes and improvement incentives. Energy-efficient upgrades often qualify for federal and state tax credits.

How Do You Choose Between Life Insurance and Annuities?

Your life stage and home situation determine the best choice. Young families with big mortgages need term life insurance every time. Empty nesters maintaining established homes benefit more from annuities.

Here's our decision framework:

• **Under 45 with mortgage debt:** Focus on term life insurance (20-30 times annual income)

• **45-60 with equity built:** Consider both products for different jobs

• **Over 60, mortgage-free:** Emphasize annuities for maintenance and improvements

Consider your home's specific risks too. Properties in fire zones need robust life insurance that covers rebuilding with fire-resistant materials. Flood-prone homes require coverage exceeding standard homeowner's policies.

What This Old House Won't Tell You

Proper financial planning enables quality improvements instead of budget shortcuts. We've inspected too many homes where owners delayed security upgrades or chose cheap materials because they hadn't planned financially.

KeyMe Locksmiths and similar providers see this constantly - homeowners who postponed security investments due to cash problems.

In our experience? Poor planning leads to poor choices.

Our Professional Recommendation

After inspecting over 10,000 homes, here's what we've learned: the best protection combines both products strategically.

**Young homeowners should:**

• Secure term life covering mortgage plus 10 years

• Start a small annuity for future major repairs

• Focus on immediate safety and code issues

**Established homeowners should:**

• Maintain adequate life insurance as equity grows

• Use annuities to fund planned improvements

• Invest in quality materials reducing long-term costs

**Empty nesters should:**

• Check if current life coverage matches home value

• Switch to income annuities for maintenance costs

• Consider permanent improvements supporting aging in place

Bottom line? Your home is likely your biggest asset. Don't gamble with weak protection or wrong financial tools.

We've watched families lose homes they'd owned for decades because they didn't plan properly. Don't let that happen to you.

Our certified team provides comprehensive home protection assessments coordinating with your financial planning. Because protecting your home's structure and financial future aren't separate decisions - they're part of the same smart strategy.

In-Depth Look

Detailed illustration of key concepts

Visual Guide

Infographic illustration for this topic

Side-by-Side Comparison

Visual comparison of options and alternatives

Sources & References

- Estate Planning Guide: Life Insurance, Annuities & Trusts

- Annuity vs Life Insurance: Income vs Protection Explained

- Life and Annuity Insurance Guide - Ohio Department of Insurance

- Tools for Retirement - NAIC

- Choosing Between Annuities and Life Insurance - WoodmenLife Blog

- Building Codes, Standards, and Regulations: Frequently Asked ...

- Building Codes and Standards - 101 Guide | ROCKWOOL Blog

- [PDF] Building Codes Toolkit for Homeowners and Occupants - FEMA

- ICC - International Code Council - ICC

- Amazon Best Sellers: Best Architectural Codes & Standards

Need Professional Help?

Find top-rated insurance services experts in your area