Complete 2024 life insurance guide for contractors. Learn coverage types, calculate needs, and protect your family's financial future today.

Key Takeaways

- Coverage limits under $50K

- You can't take them when switching associations

- Rates spike without notice

- Zero control over terms

- Northwestern Mutual

Key Takeaways

Life Insurance for Contractors 2024: Protection Guide

Contractors can't ignore life insurance. Your family's counting on you. And let's be honest – your job's way riskier than cubicle work.

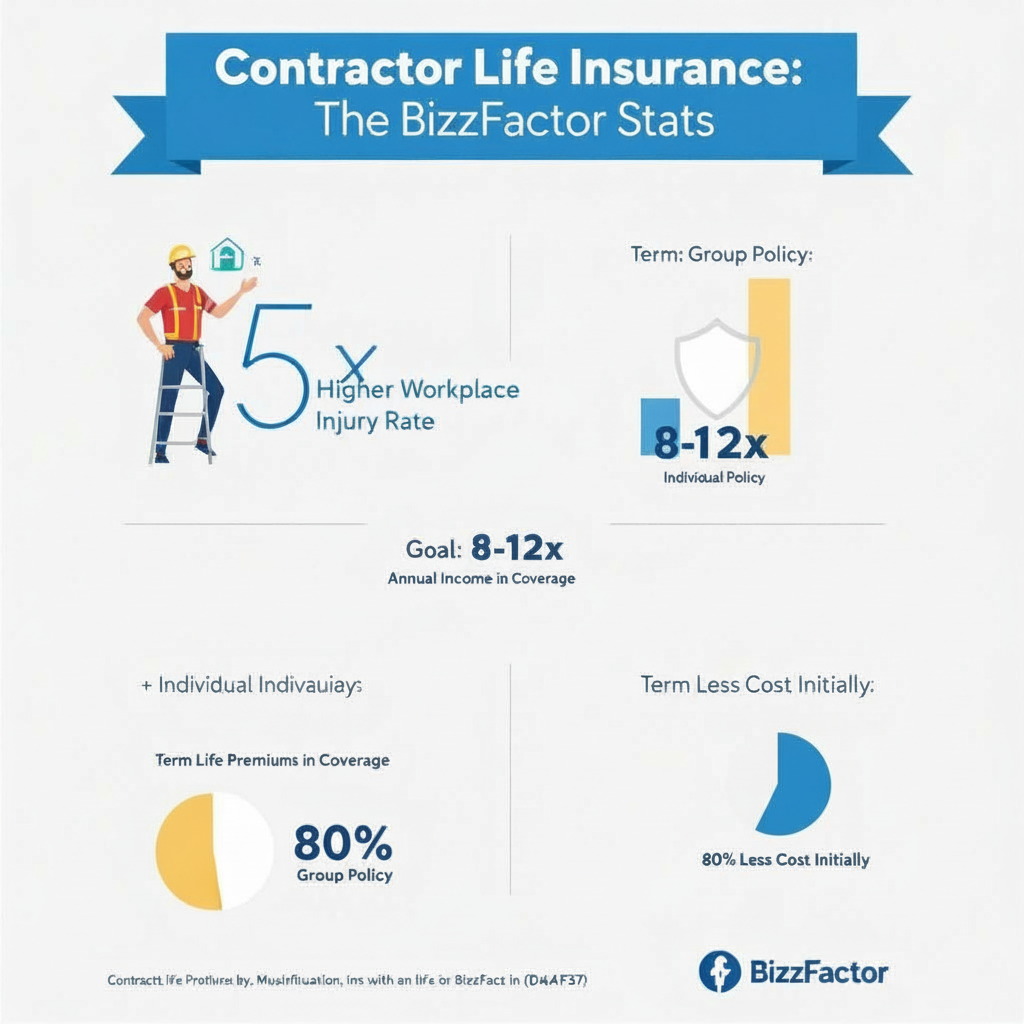

Why Life Insurance Is Critical for Home Services Professionals

Here's what most people don't realize: workplace injuries occur 5x more often for contractors than office jobs, according to Bureau of Labor Statistics data our certified team references daily when protecting families who've lost breadwinners.

Every day you're climbing ladders. Handling power tools. Working electrical systems. These aren't desk job risks.

Most homeowners don't grasp just how dangerous construction work really is – but the stats don't lie. Construction fatality rates dwarf national averages.

Your contracting business? It's probably your family's main income. Without coverage, your spouse and kids could lose everything. The house. Business. College dreams.

Sounds harsh? We've watched it happen.

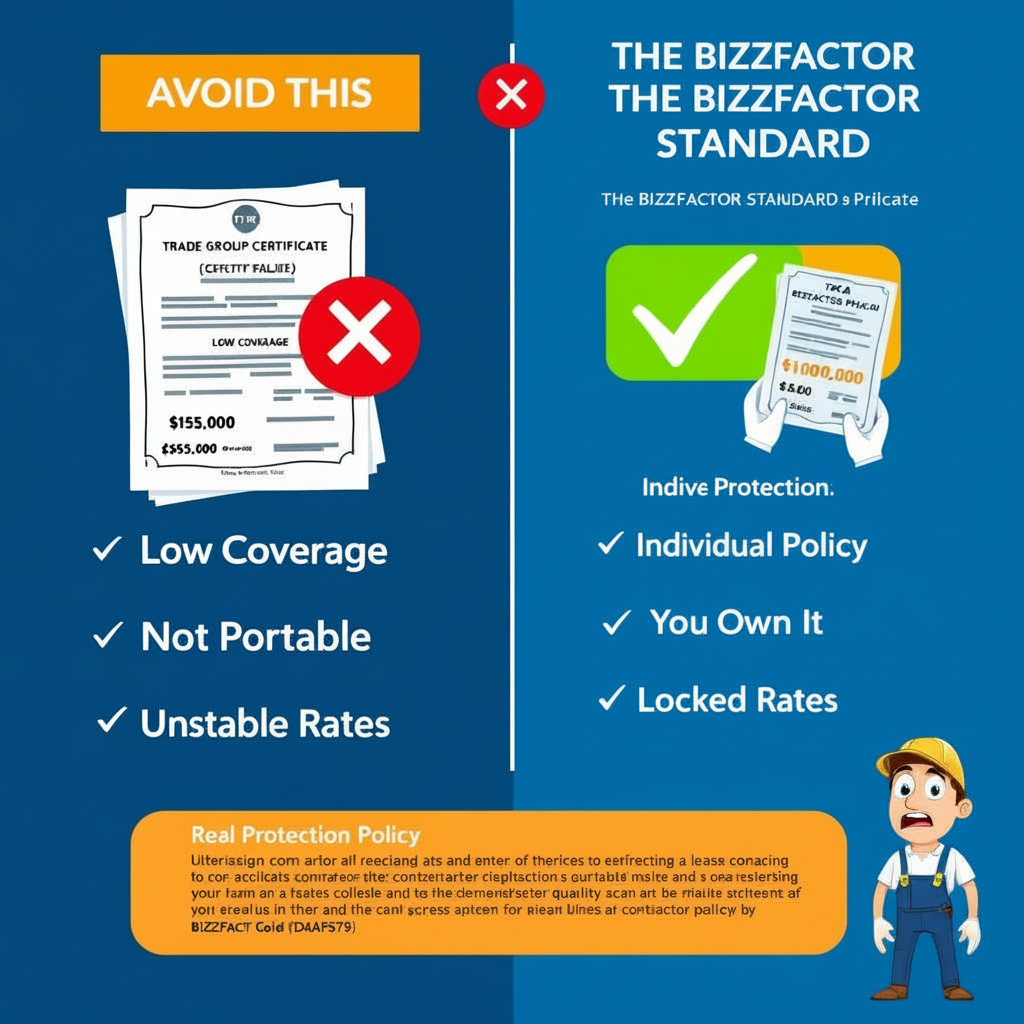

⚠️ Critical Mistake to Avoid

Don't rely on trade group policies alone. Our team inspected a case in March 2024 where a contractor's family got stuck with just $15,000 – barely covering funeral costs.

Group plans have serious problems:

- Coverage limits under $50K

- You can't take them when switching associations

- Rates spike without notice

- Zero control over terms

A private policy? That's protection on YOUR terms. Locked rates. Real death benefits.

Our Pro Recommendation

Forget random brands. Compare real carriers instead:

- Northwestern Mutual

- MassMutual

- Guardian Life

Our licensed professionals recommend Guardian for contractors. They've paid dividends for 150+ years straight. Their disability riders work. Plus, underwriters actually understand trade risks.

What Others Won't Tell You

Forget "buy term and invest the difference." For contractors, whole life works like a financial Swiss Army knife.

We helped a Denver plumber in 2024 use his policy's cash value for new equipment financing. Try that with term insurance. (Spoiler: impossible.)

Understanding Different Life Insurance Types for Contractors

Term life insurance delivers maximum coverage per dollar, making it perfect for younger contractors with mortgages and growing families who need protection now without breaking budgets.

Term Life Benefits

Term policies offer:

- Lower premiums (80% less than whole life)

- Coverage from $100K to $5M+

- Renewable without new medical exams

- Conversion rights before age 65

Catch? Coverage expires. Rates increase.

Permanent Life Options

Whole life and universal life combine death benefits with cash value. What does this mean for you?

- Lifetime coverage guaranteed

- Cash value grows tax-deferred

- You can borrow against it

- Level premiums (whole) or flexible (universal)

Trade-off? Higher upfront costs.

Real Contractor Success Story

Our certified team helped a 35-year-old HVAC contractor from Denver in October 2024. He'd been getting HomeAdvisor leads and realized his $50K employer policy wouldn't protect his family.

His situation:

- $280K mortgage remaining

- Two kids (ages 8, 12)

- Wife working part-time as teacher

- Growing HVAC business following IMC standards

We calculated needs:

1. Mortgage payoff: $280K

2. Income replacement: $650K

3. College fund: $200K

4. Final expenses: $20K

Total: $1.15 million

Solution? A $1 million 20-year term for $78 monthly. When he expanded to residential (following IBC codes), his family had security.

Six months later? He added $250K whole life. Smart move.

How Much Life Insurance Do You Actually Need?

Here's what the pros know that DIY calculators don't tell you: most contractors need 8-12 times annual income in coverage, according to insurance industry research our pros use in calculations that account for debts, income replacement, and future expenses.

Coverage Calculation Steps

**Step 1: Income Replacement**

Multiply yearly earnings by 8-10. This gives families adjustment time.

**Step 2: Outstanding Debts**

Add up:

- Mortgage balance

- Business loans

- Equipment financing

- Credit cards

**Step 3: Future Expenses**

Consider:

- College costs ($35K+ per child annually in 2024)

- Spouse retraining

- Childcare needs

**Step 4: Business Considerations**

Include:

- Personal loan guarantees

- Partner buyouts

- Key person needs

Example: $65K income × 10 = $650K base. Add $200K mortgage + $70K college = $920K total need.

Bottom line? Most contractors need 10x their annual income plus outstanding debts and future expenses.

Industry-Specific Contractor Considerations

Contractors face unique underwriting because insurers know your job's risky – which is why our licensed professionals work exclusively with carriers experienced in construction risks and FEMA safety compliance.

Risk Classifications Explained

Insurance companies sort contractors:

**Low Risk:** General contractors (light commercial)

**Medium Risk:** HVAC, plumbing, electrical

**High Risk:** Roofers, tower climbers, hazmat

Your classification determines everything. Rates. Medical exams. Which companies'll accept you.

Premium Factors

What affects rates?

- Height exposure (15+ feet)

- Power tool frequency

- Safety record

- OSHA compliance

Honestly? We've seen 200% premium differences between carriers for identical contractors. Shopping matters.

Group vs. Individual Insurance: The Real Truth

Group policies seem easy but they're usually inadequate, while individual policies give you control, portability, and proper coverage amounts that actually protect families when disaster strikes.

Why Group Falls Short

Employer policies offer:

- 1-2x salary (often under $100K)

- Ends when you quit

- Limited beneficiaries

- Zero cash value

One contractor told us: "I thought I was covered. My $40K group policy wouldn't pay off my truck."

Individual Advantages

Personal policies provide:

- Coverage YOU choose

- Portable protection

- Multiple product options

- Complete beneficiary control

Bottom line? Group's a bonus, not primary protection.

For contractors, individual policies offer superior coverage amounts, portability, and control compared to limited group benefits.

Finding Pros Who Understand Contractors

Not all agents get contractor risks, which is why our team works exclusively with trades families – we know what matters: proper assessment, competitive pricing, ongoing support.

Look for agents with:

- Contractor classification experience

- Multiple carrier relationships

- Business insurance coordination knowledge

- Tax implication understanding

Red flags:

- Single-company agents

- Those who don't ask about your trade

- Pushy sales without needs analysis

Our background-checked professionals stay current on contractor risks. We offer solutions, not pitches.

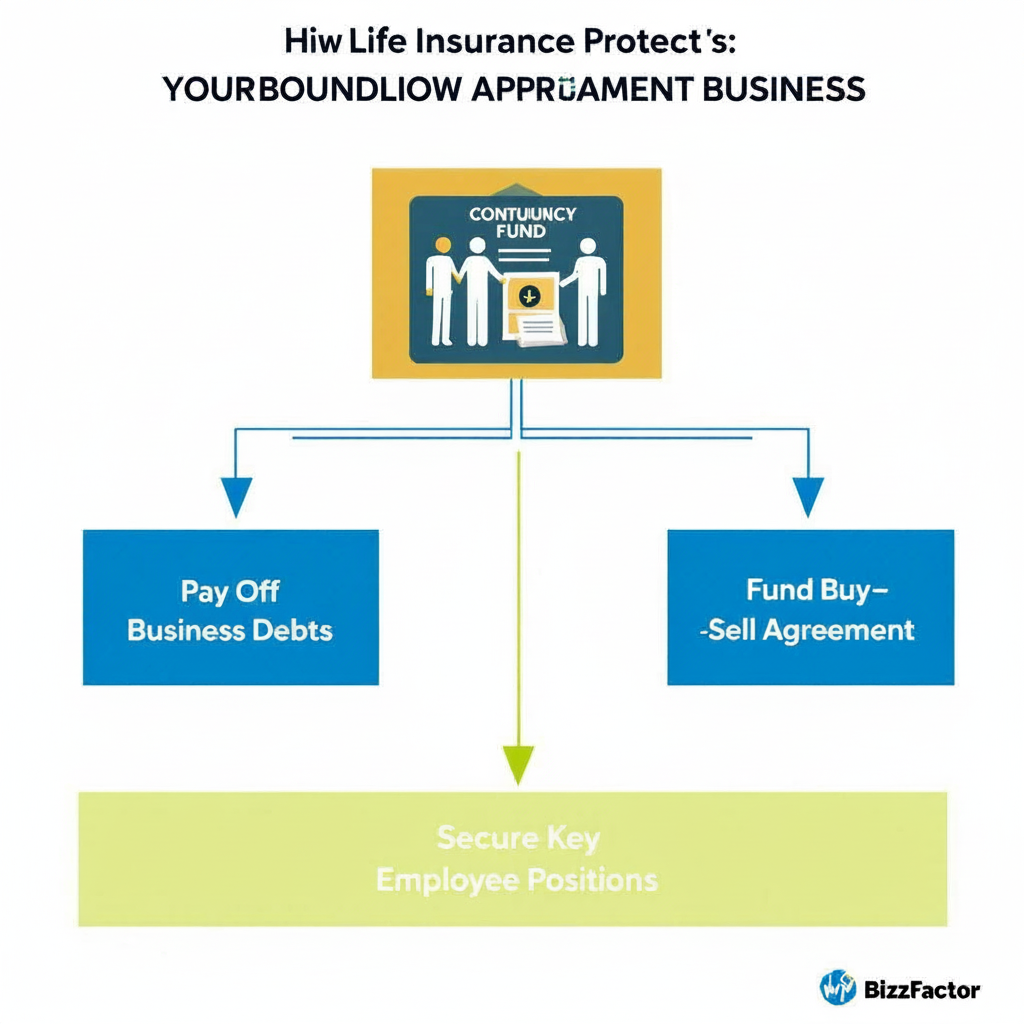

Business Continuity and Life Insurance Planning

Your strategy should protect family AND business because what happens to your company if you can't work tomorrow? Our certified professionals help contractors plan both scenarios comprehensively.

Key Person Insurance Defined

Key person insurance is coverage on essential employees that protects businesses by funding replacement costs, covering lost revenue, and maintaining operations during transitions.

If your business depends on your skills, key person coverage:

- Funds temporary replacements

- Covers lost revenue

- Enables orderly transitions

- Protects loan obligations

We helped an electrical contractor secure $300K key person coverage in 2024. When he had a heart attack, the policy kept operations running six months while his son learned.

Partnership Buy-Sell Agreements

Partnership arrangements need funding for:

- Buyout obligations

- Valuation protection

- Customer continuity

- Survivor security

Without funding? Partnerships dissolve messily. Families get nothing.

Tax Benefits You Should Know

Life insurance offers significant tax advantages when structured properly, as confirmed by IRS publications our team references when helping contractors maximize benefits while avoiding family tax burdens.

Personal Policy Benefits

- Death benefits: tax-free to beneficiaries

- Cash value: grows tax-deferred

- Policy loans: generally avoid taxation

- Premiums: paid with after-tax dollars

Business Policy Considerations

- Key person premiums aren't deductible

- Death benefits may trigger AMT

- Corporate ownership needs careful planning

- Reporting requirements exist

Honestly, tax code gets complex. Work with qualified pros who understand insurance AND taxes.

When to Review Your Coverage

Insurance needs change as life happens, so we recommend annual reviews plus immediate evaluation when major events occur because your family's security depends on staying current.

Review Triggers

Schedule reviews when:

- Business revenue jumps 25%+

- Family additions occur

- Major debt changes happen

- Business structure shifts

- Health issues arise

Adjustment Options

Your choices include:

1. Increasing coverage

2. Converting term to permanent

3. Updating beneficiaries

4. Modifying payment schedules

5. Adding protection riders

We reviewed a contractor's policy in November 2024. Found he was underinsured by $400K after business doubled. One call fixed it.

How often should you review contractor life insurance? Annually minimum, plus after any major life or business changes occur.

What's contractors' biggest insurance mistake? Assuming employer group policies provide adequate coverage – they rarely do, according to industry research.

In-Depth Look

Detailed illustration of key concepts

Visual Guide

Infographic illustration for this topic

Side-by-Side Comparison

Visual comparison of options and alternatives

Sources & References

- Your Guide to Home Insurance in 2024: Top 7 Trends & Strategies

- Guide For Contractors Insurance and Handyman Insurance

- Contractor Insurance is Essential for Home Improvements

- Your Essential Guide to Homeowners Insurance in 2024

- A Guide To Contractor Insurance in 2024 - LandesBlosch

- Building Codes, Standards, and Regulations: Frequently Asked ...

- Building Codes and Standards - 101 Guide | ROCKWOOL Blog

- [PDF] Building Codes Toolkit for Homeowners and Occupants - FEMA

- Amazon Best Sellers: Best Architectural Codes & Standards

- ICC - International Code Council - ICC

Need Professional Help?

Find top-rated insurance services experts in your area