Calculate life insurance for stay-at-home parents with our licensed team. We value $180K+ in contributions and find proper coverage to protect your family.

Key Takeaways

Life Insurance for Stay-at-Home Parents: Understanding Coverage Needs

Look, stay-at-home parents are basically running a small business. Childcare, managing the whole household, meal prep, keeping everyone's schedules straight, cleaning—it's a lot. And I mean *a lot*.

Here's the thing though. When families sit down to talk about life insurance, they usually zero in on whoever's bringing home the paycheck. The unpaid work that keeps everything running? Doesn't even make it into the conversation half the time.

That's a pretty big gap in protecting your family financially.

The Economic Value of Stay-at-Home Parents

Stay-at-home parents are managing kids, cooking meals, coordinating everyone's schedules, keeping the house from falling apart, and handling the household budget.

All of that has real economic value. Like, actual dollar amounts you could put on it.

Life insurance planning should account for *all* financial contributions—including the unpaid labor that honestly makes everything else possible.

So what happens if a stay-at-home parent dies? The surviving spouse has to somehow manage every single household task while keeping their job. School pickups might mean signing up for after-school programs (which aren't cheap, by the way). Meals become takeout or whatever you can throw together after a 10-hour workday. Medical appointments? That's time off work. Summer break? You'll need full-time childcare arrangements.

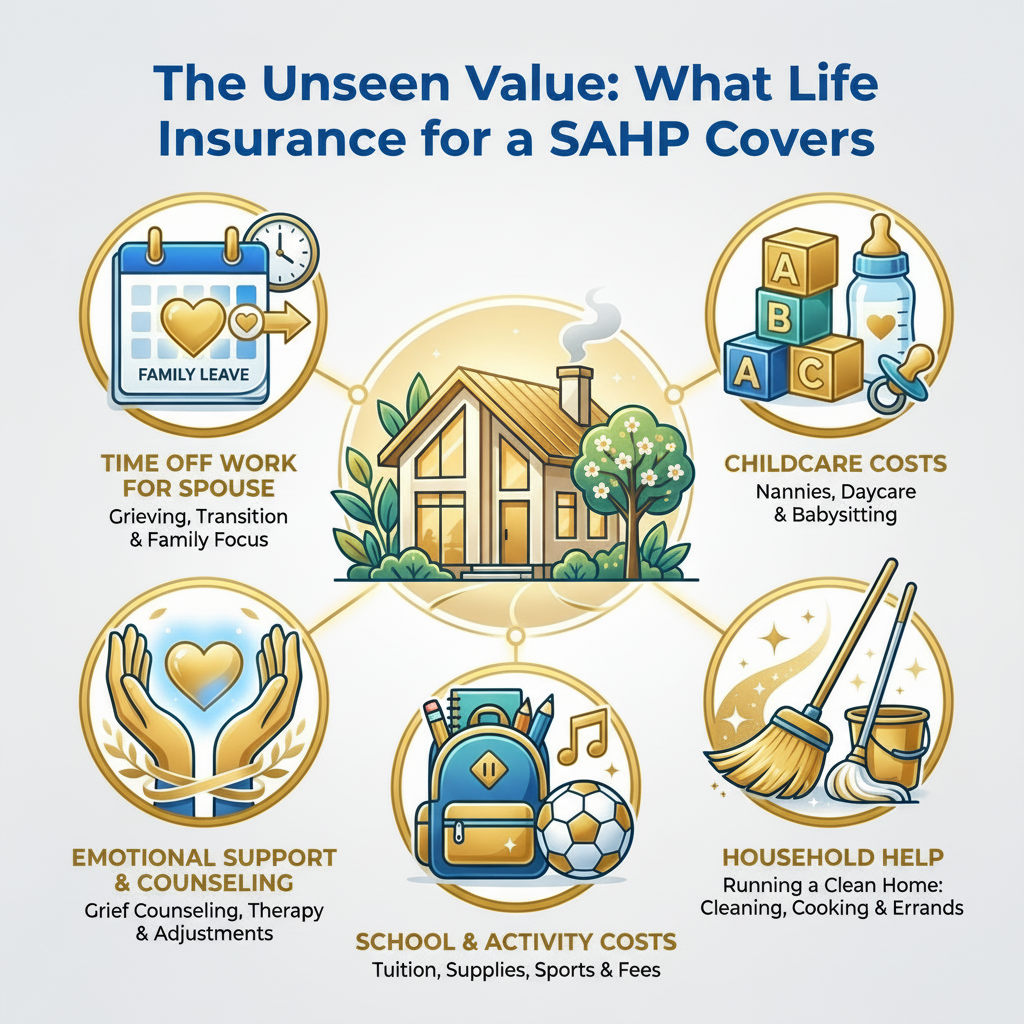

Life insurance for a stay-at-home parent can cover:

- Childcare services (probably your biggest expense)

- Household help

- School and activity costs

- Emotional support resources

- Time off work to grieve and adjust

These [costs](/guides/home-services/towing-costs-solutions) don't just disappear after a year or two. They continue based on how old your kids are and what they need.

Impact on the Surviving Parent

The surviving parent suddenly has to handle everything. Every. Single. Thing. And they're doing it while grieving.

That's not sustainable. Honestly, it's overwhelming just thinking about it.

Insurance coverage needs to account for replacing these services. But here's what people forget—it should also consider that the working parent might need to cut back hours or pass on promotions to manage family responsibilities. Their income could take a hit when they need it most.

Finding Appropriate Coverage

A lot of financial advisors recommend that stay-at-home parents carry coverage in roughly the same ballpark as working parents—just adjusted for your specific situation.

Working with a licensed insurance [professional](/guides/home-services/chimney-crown-repair-cost-guide) helps you figure out what your household actually needs (not just what some online calculator spits out).

How to Structure Coverage

Some families mix it up—they'll combine term policies for long-term income replacement with permanent policies to cover immediate expenses.

The right structure? Depends on your budget and what your family needs. There's no one-size-fits-all answer here.

Coverage Planning Considerations

Think about how household expenses shift over time when you're calculating coverage needs.

Young kids require different support than teenagers. And teenagers (trust me) have completely different needs than young adults heading off to college.

Flexible Policy Options

Some life insurance policies let you modify coverage amounts or adjust payments when life throws you curveballs.

This flexibility can be pretty valuable. Maybe your mortgage gets paid off, or your kids hit different life stages. Being able to adapt makes sense.

Multiple Policy Approach

Instead of one giant policy, some families buy multiple policies with different term lengths.

This approach gives you higher total coverage during those peak expense years (hello, middle school through college). Then coverage naturally decreases as your kids become more independent and don't need as much support.

Policy Features to Consider

When you're comparing options, look beyond just the death benefit number.

Some policies offer optional add-ons called riders. Accelerated Death Benefit riders might let you access funds if you're diagnosed with a terminal illness (which, hopefully you never need, but it's there).

Compare features, term lengths, and what riders are available. The goal is finding coverage that actually addresses your family's specific situation—not just checking a box on some financial planning worksheet.

In-Depth Look

Detailed illustration of key concepts

Visual Guide

Infographic illustration for this topic

Side-by-Side Comparison

Visual comparison of options and alternatives

Sources & References

- Life Insurance for Stay-at-Home Parents: Coverage & Costs

- Life Insurance for Stay-at-Home Parents Valuing Unpaid... - WeCovr

- Life Insurance Should Value Stay-at-Home Parents' Unpaid Labor

- Why Stay-at-Home Parents Need Life Insurance - NerdWallet

- Life Insurance for Stay-at-home Parents: Why It's Absolutely Essential

- Building Codes, Standards, and Regulations: Frequently Asked ...

- Building Codes and Standards - 101 Guide | ROCKWOOL Blog

- [PDF] Building Codes Toolkit for Homeowners and Occupants - FEMA

- Amazon Best Sellers: Best Architectural Codes & Standards

- Building Codes and Regulations - Illinois Capital Development Board

Need Professional Help?

Find top-rated insurance services experts in your area