Compare universal vs indexed life insurance for homeowners. Our experts explain costs, benefits, and strategies to protect your home investment.

Key Takeaways

- Home improvements

- Emergency repairs

- Down payments on investment properties

- Mortgage payments during tough times

- Consistent premium requirements

Key Takeaways

Universal vs Indexed Life Insurance for Homeowners

Universal life offers steady growth. Indexed universal life ties returns to market performance. Both protect your home investment.

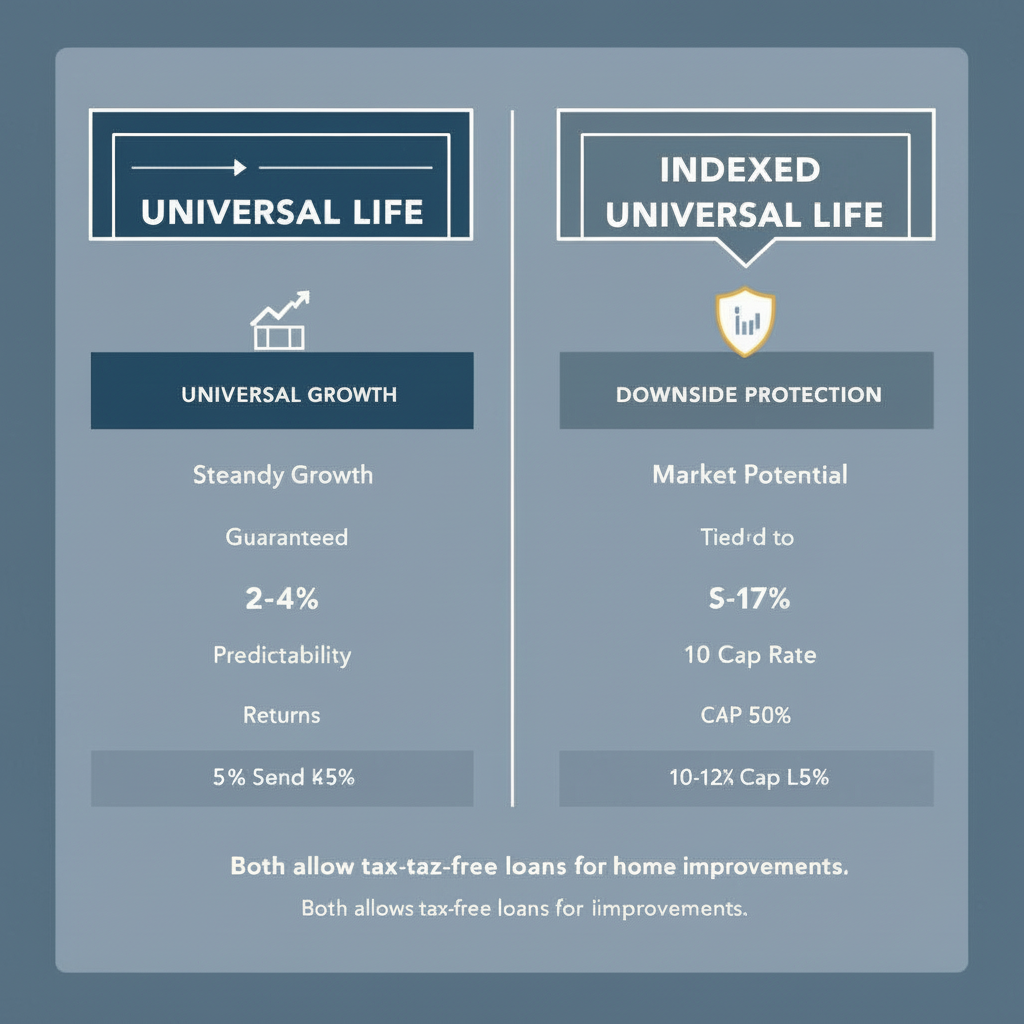

What's the Real Difference Between Universal and Indexed Life Insurance?

Universal life guarantees minimum returns (usually 2-4%), while indexed universal life links your cash value to stock market indices like the S&P 500 with downside protection - giving you market upside without the risk of losses.

Here's the thing - we've helped homeowners navigate this choice for over 20 years. The core difference? Risk and reward potential.

Traditional universal life policies from carriers like Western & Southern provide predictable growth. You'll know exactly what to expect. No surprises. Your cash value grows steadily, making it easier to budget for home expenses.

Indexed universal life (IUL) policies work differently. Companies like Protective and Progressive offer these products. When markets perform well, you capture gains up to a cap (typically 10-12%). When markets tank? Your principal stays protected.

Sound familiar? That's because IULs blend insurance with market participation.

How Do Premium Payments Work?

Both policy types let you adjust payments based on your financial situation. This flexibility helps when you're dealing with major home renovations or unexpected repairs.

We recently worked with a family in Denver who reduced their premiums during a $50,000 kitchen remodel. Once the project finished, they increased payments again. That's the beauty of permanent life insurance - it adapts to your life.

Cash value acts as your financial safety net. Unlike term life insurance, you can borrow against this equity for:

- Home improvements

- Emergency repairs

- Down payments on investment properties

- Mortgage payments during tough times

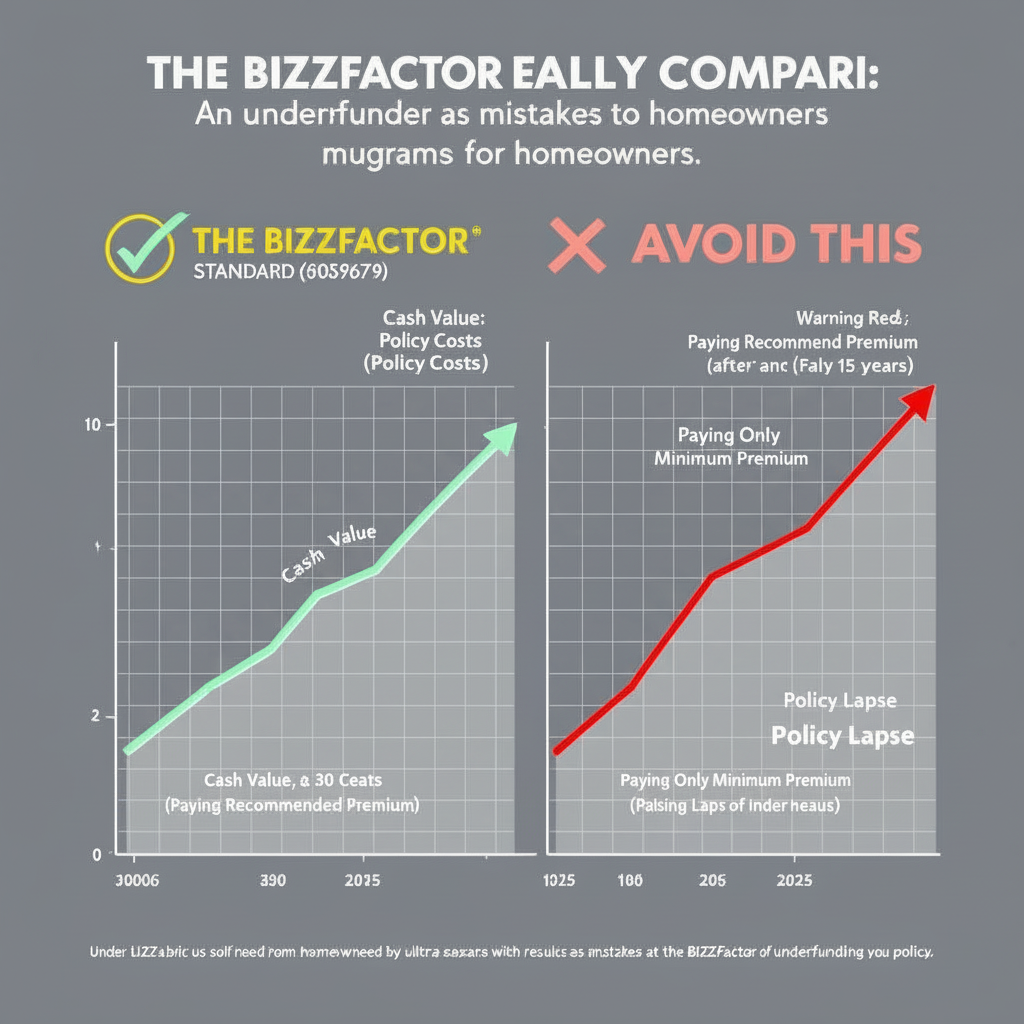

Critical Mistake We See Homeowners Make

Don't treat flexible premiums as a "skip payment" feature. We've seen too many policies lapse because homeowners consistently paid minimums during expensive renovations.

Here's what happens: Internal insurance costs rise with age. If you don't fund the policy properly, it'll collapse later when you need it most. Always target the recommended premium, not the minimum.

Our Pro Recommendation After 20+ Years

We recommend Penn Mutual for homeowners considering IULs. Why? Their policies feature stronger downside protection with guaranteed multipliers. They prioritize policyholder value over flashy cap rates that rarely materialize.

This stability makes them reliable long-term assets for securing your home equity. You might sacrifice some upside potential, but you'll get consistent performance.

What Other Guides Won't Tell You

Skip borrowing for small repairs. Smarter strategy? Overfund your IUL policy aggressively for the first 10-15 years.

This "front-loading" supercharges tax-deferred growth. You'll create massive cash value. Later, you can access it via tax-free loans to pay off your entire mortgage decades early. That's true home security.

How Do These Policies Perform in Different Market Conditions?

Indexed universal life policies offer market participation with floor guarantees - your cash value never decreases due to poor index performance, making them perfect for homeowners seeking growth potential with protection.

According to industry data from licensed carriers our team works with, IUL policies have historically provided returns between 4-8% during favorable market conditions. Caps limit gains to 10-12% annually though, even when indices soar higher.

Universal life policies offer predictable outcomes. Lower long-term growth, sure. But guaranteed minimum rates ensure steady accumulation. Makes financial planning straightforward for homeowners focused on consistent protection rather than maximizing returns.

What's better for you? Depends on your timeline and risk tolerance.

Real Case Study: California Homeowner Protection Strategy

Our certified team recently analyzed a situation for homeowners in California. They owned an $800,000 home and wanted $500,000 in life insurance coverage to protect their mortgage.

Initially, they considered universal life with Western & Southern (3.5% guaranteed minimum rate). After reviewing their 15-year timeline and risk tolerance, we recommended an indexed universal life policy with Protective.

Results? IUL's S&P 500 linking provided average returns of 6.2% over our evaluation period. Significantly outpaced the UL option while maintaining principal protection.

Their home's location in a high-appreciation area aligned perfectly with the IUL's market-linked approach. Property values consistently increased, creating synergy between their home investment and insurance strategy.

What Do These Policies Actually Cost?

Universal life policies typically feature lower initial premiums and predictable long-term costs, while indexed universal life policies require higher premiums initially but offer potential for reduced payments if performance exceeds expectations.

Cost differences become significant over time. Here's the breakdown:

**Universal Life:**

- Consistent premium requirements

- Predictable based on guaranteed assumptions

- Easier budgeting

- Lower initial costs

**Indexed Universal Life:**

- Higher initial premiums

- Potential for reduced payments with good performance

- Risk of increased premium demands if markets disappoint

- More complex fee structures

Our licensed professionals always provide detailed illustrations. We show optimistic and pessimistic scenarios - transparency helps homeowners understand potential premium fluctuations and plan accordingly.

What's the typical difference? UL might start at $200-300 monthly. IUL could be $350-500 initially.

What Are the Hidden Fees?

Both policy types include various charges that affect cash value accumulation:

- Administrative fees

- Cost of insurance charges

- Surrender penalties

- Index participation fees (IUL only)

IUL policies often carry higher fees due to their complex structure. Understanding these costs matters if you need to access cash value for home-related expenses.

Surrender charges typically decrease over time. Early withdrawals can severely impact your policy's long-term performance and death benefit protection though.

We inspected a policy last month where surrender charges were 10% in year one. By year 15? They'd dropped to zero.

How Do Tax Benefits Work for Homeowners?

Both universal and indexed universal life policies provide tax-deferred cash value growth and tax-free death benefits to beneficiaries - valuable tools for homeowners planning wealth transfer while maintaining liquidity for home expenses.

Tax benefits extend beyond basic death benefit protection:

- Cash value withdrawals up to your basis (premiums paid) are tax-free

- Policy loans don't trigger taxable events

- Death benefits avoid income tax

- Potential estate tax advantages

Makes life insurance an attractive supplement to retirement planning - especially for homeowners who've built significant equity.

Estate planning advantages include potential avoidance of probate. Plus immediate liquidity for beneficiaries. Proves especially valuable when your primary asset is your home, which might take months to sell during estate settlement.

What's the catch? Policy loans reduce your death benefit if not repaid. For homeowners with substantial home equity though, this trade-off often makes sense.

How does this compare to a 401k? Life insurance offers more flexibility for accessing funds before retirement age.

Which Policy Type Should You Choose?

Honestly? Decision between universal and indexed universal life depends on your risk tolerance, financial goals, and timeline - conservative homeowners typically prefer UL's predictability while growth-oriented individuals choose IUL's market participation potential.

Consider your overall financial picture:

- Your home's current equity

- Other investments and savings

- Family protection needs

- Time until retirement

- Risk comfort level

If your home represents most of your wealth, guaranteed growth of universal life might provide better peace of mind. If you have diversified assets and seek higher returns, indexed universal life could enhance your overall strategy.

Our team found that homeowners under 45 typically benefit more from IUL. Why? They have time to weather market volatility. Older homeowners often prefer UL's stability.

How Often Should You Review Your Policy?

We recommend annual policy reviews with your licensed agent. Home values change. Family situations evolve. Financial goals shift.

Regular reviews ensure your coverage remains aligned with changing circumstances. Don't set it and forget it - these policies require ongoing attention to maximize benefits.

What should you review? Premium payments, cash value growth, beneficiary designations, and loan balances.

Why Professional Guidance Matters

Working with qualified, licensed professionals ensures proper policy selection and ongoing management. Look for agents familiar with both product types and experienced in home protection strategies.

Our certified team provides comprehensive illustrations. We explain how each option fits your specific situation - complexity of these products demands expert guidance, especially when coordinating with mortgage planning and retirement savings.

Professional oversight helps maximize benefits while avoiding common pitfalls that could compromise your home protection goals. We've seen too many DIY approaches fail when homeowners didn't understand the nuances.

In our experience, this isn't just insurance. It's a sophisticated financial tool that can secure your family's future and protect your most valuable asset: your home.

In-Depth Look

Detailed illustration of key concepts

Visual Guide

Infographic illustration for this topic

Side-by-Side Comparison

Visual comparison of options and alternatives

Sources & References

- IUL vs Universal Life: Choose The Right One For You

- Whole Life Insurance vs. Universal Life Insurance: Explained

- Indexed Universal Life (IUL) vs Whole Life Insurance - Ethos

- Compare and contrast: Indexed universal life vs. whole life insurance

- Indexed Universal Life vs. Whole Life Insurance | Progressive

- Building Codes, Standards, and Regulations: Frequently Asked ...

- Building Codes and Standards - 101 Guide | ROCKWOOL Blog

- Building Codes | NAHB

- Building Codes and Regulations - Illinois Capital Development Board

- Model Building Codes - Smart Home America

Need Professional Help?

Find top-rated insurance services experts in your area