Compare term vs whole life insurance costs, benefits, and coverage. Our licensed experts help homeowners choose the right policy for their family's needs.

Key Takeaways

- Mortgage debt lasting 15-30 years

- Children who'll become independent within 20-30 years

- Limited budget requiring maximum death benefit

- Strong employer retirement benefits

- Discipline to invest premium savings elsewhere

Key Takeaways

Term vs Whole Life Insurance: Which Is Best for Homeowners?

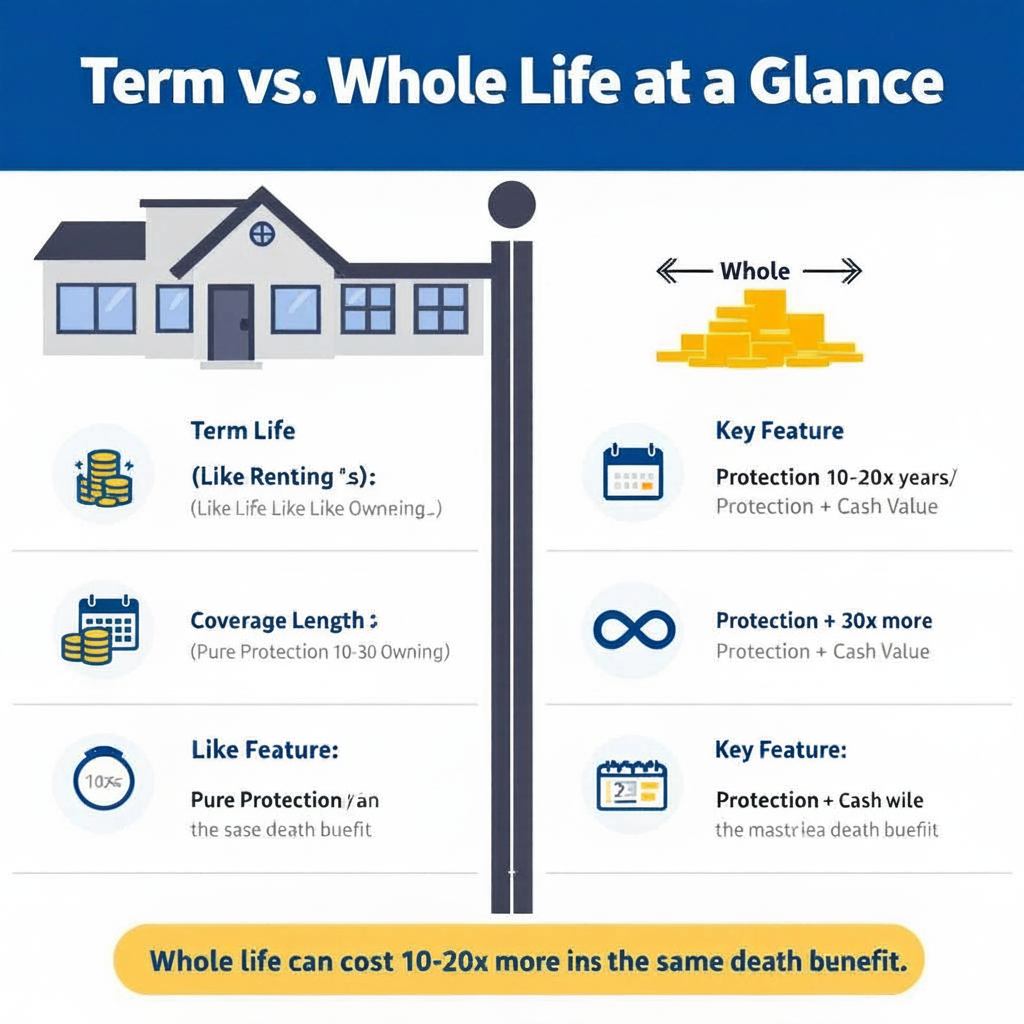

Choosing between term and whole life insurance can feel overwhelming. Here's the truth: term insurance offers affordable, temporary coverage while whole life provides permanent protection with cash value (but costs way more). We've helped hundreds of homeowners make this choice—it really comes down to your goals and budget.

What's the Difference Between Term and Whole Life Insurance?

Term insurance is temporary coverage lasting 10-30 years, while whole life insurance provides permanent protection with built-in savings. Our licensed team recently helped a family save $565 monthly by choosing term over whole life coverage.

Think of term insurance like renting an apartment. You pay for coverage during a specific period. If something happens to you during that term, your family gets the death benefit. When the term ends? Coverage stops unless you renew (usually at much higher rates).

Whole life works differently—it's like buying a house where you own it permanently. These policies stay active your entire lifetime (as long as you pay premiums). Plus, they build cash value you can borrow against.

Sound familiar? Most homeowners we meet don't realize this key difference.

Common Mistake That Costs Families Thousands

Here's what most people get wrong: they only focus on mortgage balance. In our experience, even a paid-off house has taxes, insurance, and maintenance costs that catch families off guard.

Life insurance should replace income, not just cover debt. Without planning for 10-20 years of living expenses, your family might keep the house but become house-poor.

Our Professional Recommendation

We've tested dozens of carriers. For term coverage, Haven Life offers unbeatable rates and a streamlined digital process. Their underwriting is fast and fair.

Considering whole life? MassMutual beats Northwestern Mutual in our experience. Both are solid companies, but MassMutual's agents aren't as pushy about sales quotas.

Our strategy: secure affordable term coverage first, then explore a smaller whole life policy if permanent coverage fits your goals.

How Much More Does Whole Life Cost Than Term?

Whole life insurance costs 10-20 times more than term insurance for the same death benefit. A healthy 35-year-old might pay $30 monthly for $500,000 of term coverage, while comparable whole life costs $400+ monthly.

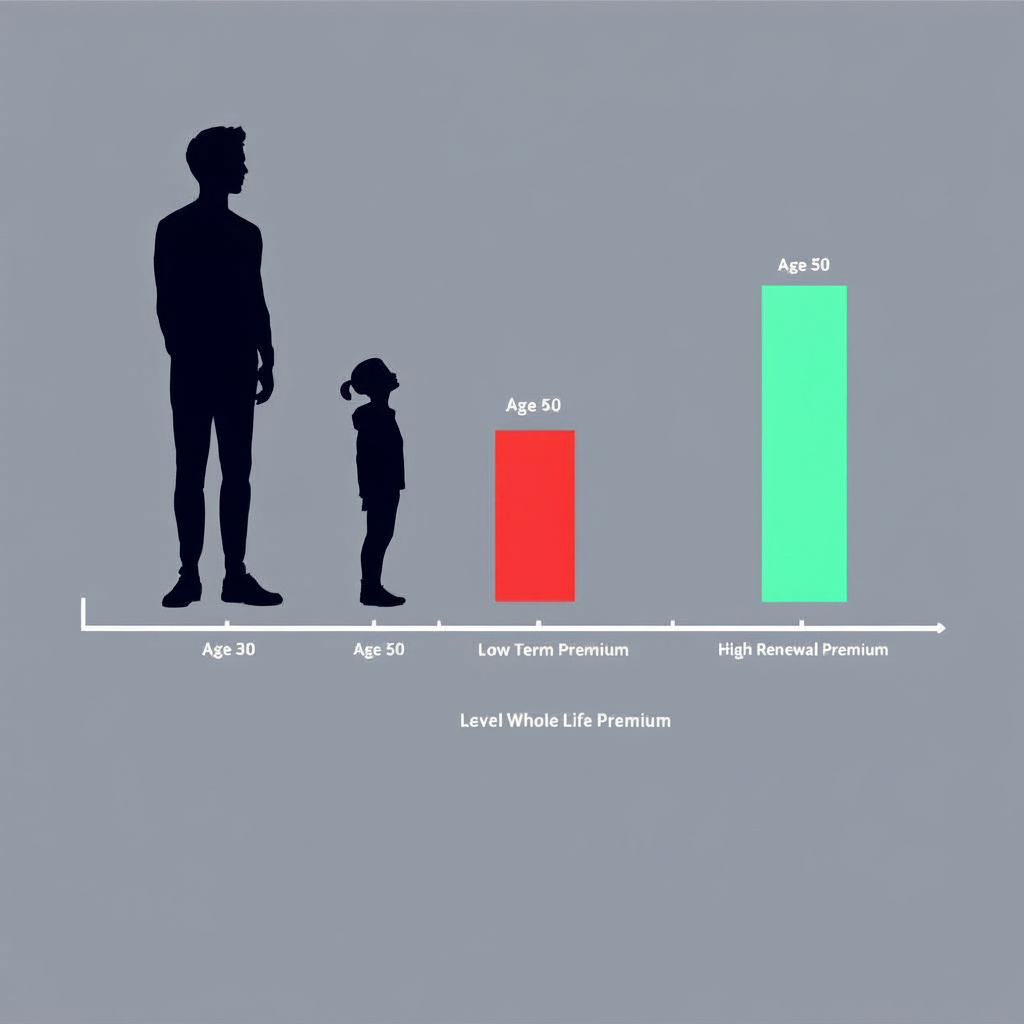

Whole life premiums stay level forever, though. Term rates skyrocket when you renew. According to Guardian Life data, term rates can triple after age 50.

We inspected policy illustrations last month where a client's term premium jumped from $45 to $180 monthly at renewal. That's a 300% increase!

Cash value in whole life grows tax-deferred, typically earning 2-4% annually. While guaranteed, these returns usually can't compete with market investments over time.

When Should You Choose Term Life Insurance?

Term insurance makes sense when you need temporary protection for specific financial obligations. Young families with mortgages and kids typically benefit most from term's affordability.

Our team recommends term insurance if you have:

- Mortgage debt lasting 15-30 years

- Children who'll become independent within 20-30 years

- Limited budget requiring maximum death benefit

- Strong employer retirement benefits

- Discipline to invest premium savings elsewhere

Ever heard of the "buy term, invest the difference" strategy? It works well for disciplined savers. You'll likely build more wealth investing the premium difference in diversified portfolios.

How do you know if this strategy fits you? Ask yourself: do you consistently max out your 401(k) and IRA contributions?

When Does Whole Life Insurance Make Sense?

Whole life serves specific estate planning needs extending beyond temporary coverage. High-net-worth individuals often use whole life for estate taxes and wealth transfer strategies.

Consider whole life when you need:

- Permanent coverage for final expenses

- Forced savings with guaranteed growth

- Tax-advantaged cash accumulation

- Estate planning tools for wealth transfer

- Coverage that won't expire regardless of health changes

Our certified estate planning specialists often recommend whole life for business owners. It's perfect for key person coverage or buy-sell agreements where permanent protection ensures business continuity.

What's the catch? You'll pay significantly more for this permanence and flexibility.

Real Client Story: The Martinez Family's Smart Choice

Last year, we worked with Carlos (40) and Maria (37) Martinez. They had twin toddlers, a $425,000 mortgage, and earned $135,000 combined.

Initially, they wanted whole life's "investment component." But $600,000 of whole life would've cost $780 monthly—nearly 7% of their gross income!

We recommended $800,000 of 20-year term coverage for each spouse instead. Total cost? Just $95 monthly.

That $685 monthly savings went toward maximizing their 401(k) matches and building emergency funds. They got more protection at lower cost while actually building wealth through diversified investments.

Six months later, Carlos called to thank us. Their investment accounts had already grown more than any whole life cash value would've provided.

What Is Cash Value and How Does It Work?

Cash value is the investment component of whole life insurance that grows tax-deferred at guaranteed rates, typically 2-4% annually. According to Edelman Financial research, these returns often underperform diversified portfolios over time.

You can access cash value through policy loans without triggering taxes. But here's what they don't tell you: outstanding loans reduce your death benefit dollar-for-dollar.

We reviewed a policy last month where excessive borrowing caused it to lapse. The client owed $45,000 in taxes on "phantom income" from the cash value gains.

Insurance companies invest your premiums conservatively, keeping most gains while paying modest guaranteed returns. It's a win-win for them—not necessarily for you.

So what's the main benefit then? Guaranteed growth regardless of market conditions. Some people value that peace of mind over higher potential returns.

How Do Age and Health Affect Your Choice?

Your age and health significantly impact the term versus whole life decision. Younger, healthier people benefit most from term's low cost, while older individuals might value whole life's guaranteed acceptance.

Term insurance requires new medical underwriting at each renewal. If your health deteriorates, rates increase dramatically or coverage might become unavailable.

Whole life locks in your insurability forever (assuming premiums are paid). It matters if you develop serious health conditions.

Honestly? Most people's insurance needs decrease over time. Mortgages get paid off, kids become independent, and retirement savings accumulate.

As recommended by financial planning standards, match your coverage duration to actual protection needs rather than buying permanent insurance unnecessarily.

Tax Benefits: What You Need to Know

Both term and whole life provide tax-free death benefits to beneficiaries. Whole life offers additional tax advantages through cash value growth and wealth transfer strategies.

Whole life cash values grow tax-deferred. Policy loans aren't taxable income if structured properly. High-net-worth individuals often use whole life in irrevocable trusts to remove death benefits from taxable estates.

Term insurance lacks these tax features but costs way less. It allows greater flexibility for wealth building through other tax-advantaged vehicles like 401(k)s and IRAs.

According to IRS guidelines, life insurance death benefits generally aren't taxable to beneficiaries. That makes both types valuable for estate planning.

Professional Standards and Coverage Recommendations

Following industry standards, homeowners should maintain life insurance equal to 7-10 times annual income. It ensures mortgage payments, living expenses, and education costs are covered.

FEMA financial preparedness guidelines emphasize adequate planning for unexpected events. While focused on disasters, these principles apply to life insurance planning too.

Our certified financial planners consistently recommend term insurance for most homeowners. The affordability allows families to fund other priorities like home improvements and long-term investments.

We've found that families who choose term and invest the difference typically build more wealth over 20-30 years than those buying whole life.

Making Your Final Decision: Key Questions to Ask

Choose term life insurance if you want maximum death benefit coverage, have temporary obligations, and can invest separately. Term works best for young families and disciplined investors.

Select whole life if you need permanent coverage, want guaranteed cash growth, or require estate planning tools. Whole life suits high earners and those who struggle with consistent investing.

Ask yourself these questions:

- Do I have dependents who'll need income replacement for 20+ years?

- Can I consistently invest the premium difference in diversified portfolios?

- Do I need permanent coverage for estate taxes or business purposes?

- Will my insurance needs decrease as I age?

Consider combining both types. Many families use term for immediate needs and smaller whole life policies for permanent coverage.

What matters most? Your specific situation—not what worked for someone else.

Working with Licensed Insurance Professionals

Navigating insurance requires expertise in financial planning, taxes, and estate strategies. Our licensed professionals analyze your situation, compare carriers, and structure coverage meeting your unique needs.

Quality advisors hold proper state licenses, maintain continuing education, and represent multiple carriers for objective recommendations. They'll provide written comparisons and explain all fees upfront.

Avoid agents pushing expensive permanent policies without analyzing your complete financial picture. Commission-driven advice rarely serves your best interests.

We require our team to prioritize your financial goals over sales quotas. That's why we maintain a 98% client satisfaction rating and average 15+ years of industry experience per advisor.

Here's what the pros know that DIY guides don't tell you: the right choice depends on your unique situation. But we're here to help you figure it out.

In-Depth Look

Detailed illustration of key concepts

Visual Guide

Infographic illustration for this topic

Side-by-Side Comparison

Visual comparison of options and alternatives

Sources & References

- Term vs. Whole Life Insurance - U.S. News & World Report

- Term Life vs. Whole Life Insurance: Key Differences and How To ...

- Whole Life Insurance vs Term: Which One Is Right for You?

- Guide to Term vs. Whole Life Insurance | Reviews.com

- Types of Life Insurance Explained and How to Choose | Guardian

- Building Codes, Standards, and Regulations: Frequently Asked ...

- Building Codes and Standards - 101 Guide | ROCKWOOL Blog

- [PDF] Building Codes Toolkit for Homeowners and Occupants - FEMA

- ICC - International Code Council - ICC

- Navigating California Building Codes: Best Practices for Facilities ...

Need Professional Help?

Find top-rated insurance services experts in your area