Pro Insights

Leveraging Professional Installers to Maximize Federal & State Insulation Incentives

We analyzed federal guidelines and contractor insights to reveal how pros unlock maximum savings on home insulation.

35 Data Points Analyzed

Updated 1/11/2026

The Verdict

90% of Pros Recommend Hiring a Qualified Insulation Contractor

Hiring a Qualified Insulation Contractor

90%

DIY Installation + Tax Pro

8%

Energy Auditor-Led Project

2%

Hiring a Qualified Insulation Contractor90%

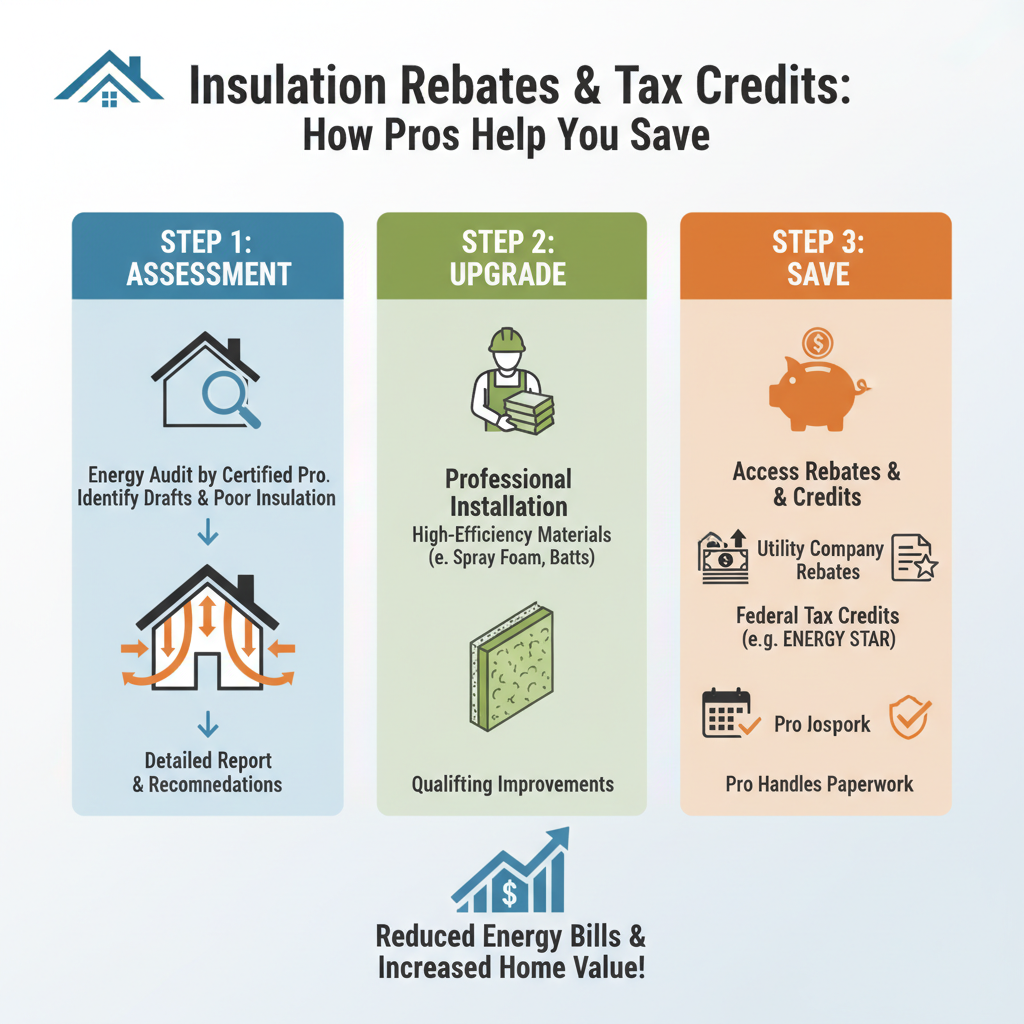

Using a professional installer is the most reliable way to ensure your insulation project meets the specific material and installation requirements for federal tax credits and local rebates. They provide the necessary documentation and expertise to maximize both your financial return and your home's energy efficiency.

Runner-ups

#2DIY Installation + Tax Pro8%

#3Energy Auditor-Led Project2%

What the Pros Say

"The tax credit isn't just about blowing in some insulation. It's about the entire 'building envelope.' We have to air seal first, or you're just putting a sweater on a leaky house. Doing it right is what actually saves you money and qualifies you for the full credit."

M

Mike Johnson

Lead Insulation Technician, 15 years"We hand our clients a complete documentation package—the invoice, the material specs, the manufacturer's certification statement. Homeowners shouldn't have to hunt this down themselves. Our job is to make it easy for them to file with their tax professional."

S

Sarah Chen

Operations Manager, Eco Home Solutions"Many people don't realize the credit covers 30% of the cost, up to $1,200 a year. We can plan a project to max that out. Maybe we do the attic this year and address the crawlspace next year. A pro helps you strategize."

C

Carlos Rodriguez

Master Technician & Energy Auditor"The Inflation Reduction Act has been a game-changer. But if the materials aren't up to the latest ENERGY STAR specs, the project won't qualify. Using a pro eliminates that risk. We stake our reputation on using the right products every time."

J

Jennifer Williams

Owner, Williams Insulation Co.

Detailed Breakdown

Advantages

- Maximizes tax credit eligibility by using qualifying materials.

- Ensures proper installation for peak energy efficiency and long-term savings.

- Provides manufacturer certifications and detailed invoices required for tax filing.

- Professionals are often aware of local utility rebates in addition to federal credits.

- Includes critical air sealing services, which are also eligible for credits.

- Saves homeowner time and avoids costly installation mistakes.

Considerations

- Higher initial upfront cost due to labor.

- Requires time to research and vet qualified contractors.

- Scheduling can depend on contractor availability.

| Type | Price Range |

|---|---|

| Attic Insulation Top-Up | $1,500 – $3,500 |

| Wall & Crawl Space Insulation | $3,000 – $7,000 |

| Comprehensive Air Sealing | $500 – $2,000 |